When it comes to investing, there are numerous terms and concepts that can be confusing, especially for beginners. One such term is the "dead cat bounce," which refers to a temporary recovery in the price of a stock or asset after a significant decline. In this article, we will delve into the world of investing and explore what a dead cat bounce means, its causes, and provide examples to help you better understand this phenomenon.

What is a Dead Cat Bounce?

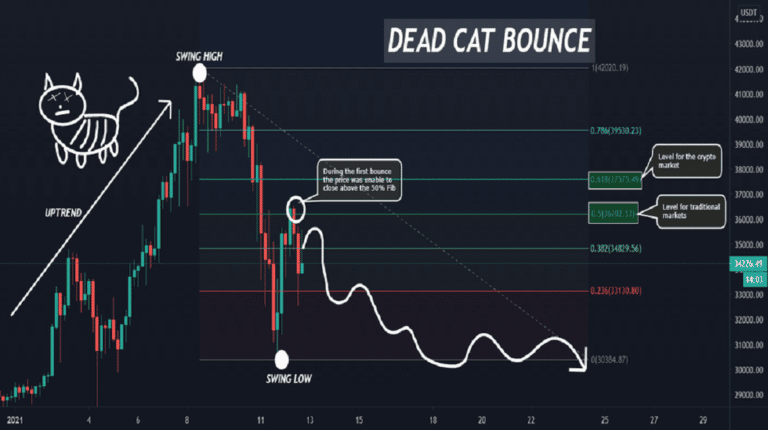

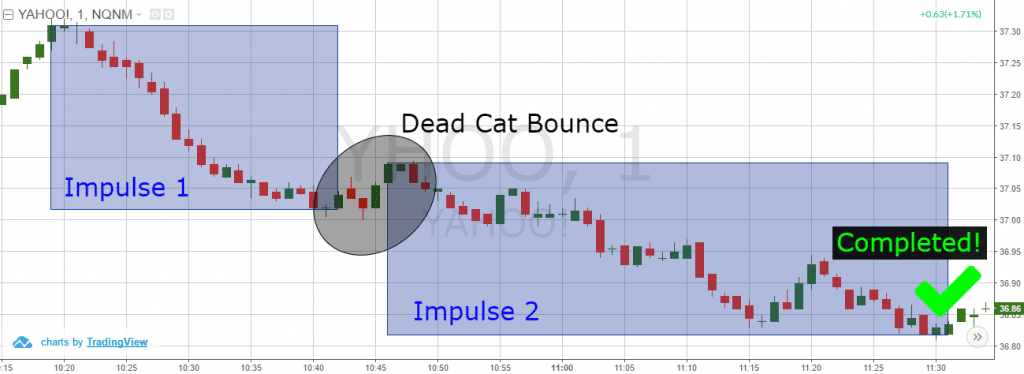

A dead cat bounce is a brief and false indication of a rebound in the price of a stock or asset after a substantial drop. The term is derived from the idea that even a dead cat will bounce if dropped from a great height, but it won't come back to life. Similarly, a dead cat bounce in investing is a temporary and short-lived recovery that is often followed by another downturn.

Causes of a Dead Cat Bounce

There are several reasons why a dead cat bounce occurs in the market. Some of the common causes include:

Overreaction: Investors may overreact to a company's bad news, causing the stock price to drop excessively. As the news is digested, the stock price may rebound temporarily.

Short covering: Short sellers may cover their positions, leading to a temporary increase in the stock price.

Technical factors: Technical indicators, such as oversold conditions, can trigger a bounce in the stock price.

Examples of Dead Cat Bounce

To illustrate the concept of a dead cat bounce, let's consider a few examples:

Enron Corporation: In 2001, Enron's stock price plummeted from $90 to $1 due to a major accounting scandal. However, the stock price briefly rebounded to $10 before eventually filing for bankruptcy.

Lehman Brothers: During the 2008 financial crisis, Lehman Brothers' stock price dropped from $86 to $0.10. Although the stock price briefly bounced back to $0.50, it ultimately filed for bankruptcy.

GameStop Corp.: In 2020, GameStop's stock price fell from $30 to $3 due to the COVID-19 pandemic. The stock price briefly rebounded to $10 but eventually returned to its downward trend.

In conclusion, a dead cat bounce is a temporary and false indication of a rebound in the price of a stock or asset after a significant decline. It is essential for investors to understand this phenomenon to avoid getting caught up in a false sense of security. By recognizing the causes and examples of a dead cat bounce, investors can make more informed decisions and avoid potential losses. Remember, a dead cat bounce is not a sign of a long-term recovery, and it's crucial to remain cautious and do your research before investing in any asset.

As an investor, it's essential to stay informed and up-to-date with market trends and analysis. By doing so, you can make informed decisions and avoid falling prey to the dead cat bounce phenomenon. Whether you're a seasoned investor or just starting out, understanding this concept can help you navigate the complex world of investing and make more informed decisions.